Features

TT Webtrader

Our cutting-edge trading terminal for retail traders has a comprehensive set of powerful proprietary tools and functionalities aimed at traders of all experience levels. TT Webtrader is fully customisable by both traders and brokers to create a perfectly tailored trading experience.

Powerful charting capabilities

With multiple chart views and advanced drawing tools, traders can perform multi-timeframe technical analysis via our robust widget-based system, opening your traders to powerful trading and linked watchlists directly from the chart.

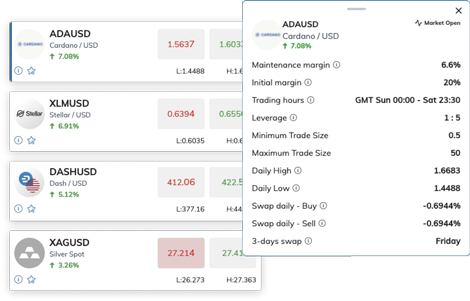

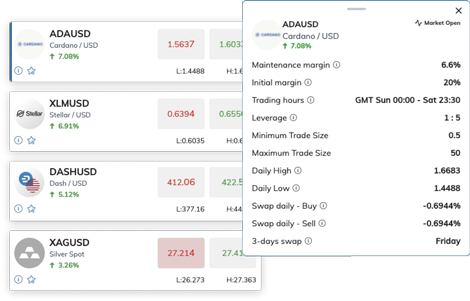

Fully customisable watchlists with enhanced multi-view

Trading directly from the list or tiled view, traders of any level can apply preconfigured Stop Loss/Take Profits with a simple click. Watchlists are entirely customisable and are available to both broker and client.

Easily customisable for both traders and brokers

The trading platform provides brokers and their traders with comprehensive control over system configuration to offer the perfect setup for the best possible experience. With configurable layouts, workspaces, watchlists, a modular interface, and multi-screen arrangements, brokers can surpass customer expectations and give traders the most powerful tools within a user-friendly environment.

Trading Dashboard

With data analysis and user experience at the centre of our motivation, our dashboard clearly and informatively displays trading performance and habits on an instrument, asset class or account level and presents metrics such as intraday performance, risk/reward ratios, win rates and winning/losing trade holding times.

REQUEST A DEMO

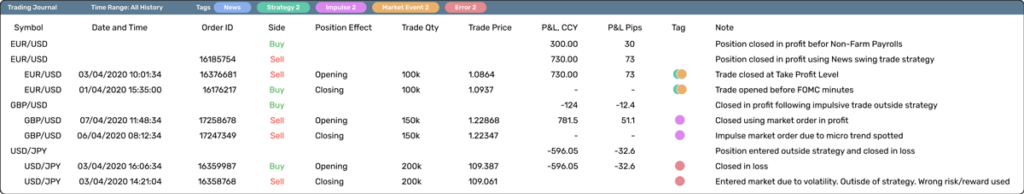

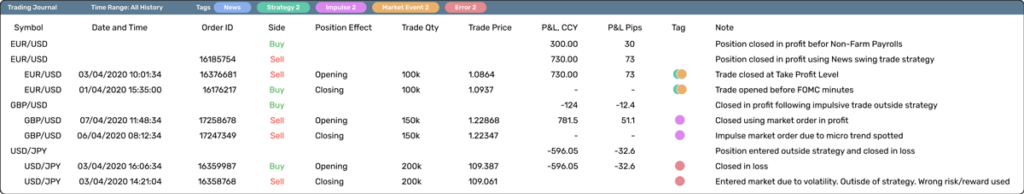

Trading Journal

The journal allows users to save notes on trades and positions, giving them future insights into why they entered or exited positions, thus enabling users to plan and strategise their trading

This innovative tool also promotes increased engagement throughout the platform.

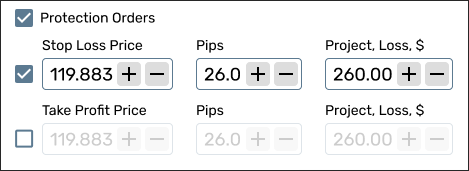

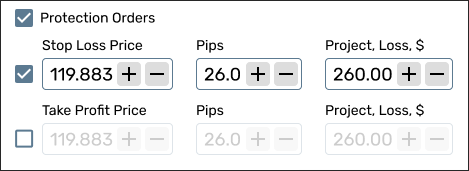

Risk management for traders

Enhanced risk management tools for traders allows traders to achieve their desired risk:reward ratios by preconfiguring Stop Loss/Take Profit levels per instrument or easily factor in the % of Balance at risk when entering trades. The dashboard and journal let traders monitor their risk management performance on an account, instrument or asset class level.

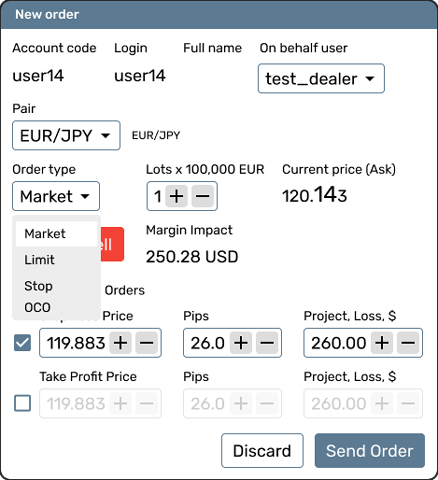

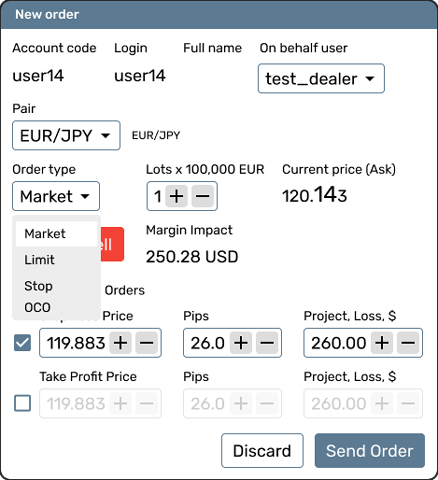

For all trading styles

Available order types include market, limit, stop and OCO orders. For easy trading, one-click trading is possible across the platform. Brokers can choose from Hedging or Net-Based for their customers.

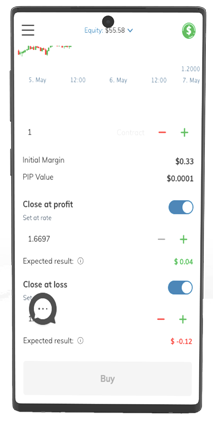

Mobile

Native apps for iOS and Android allow traders access to their accounts anytime, anywhere, providing real-time monitoring of trading portfolios, access to market data, and news.

Powerful Charting

An optimised mobile experience allows traders to perform multi-timeframe technical analysis via our robust widget-based system, opening your traders to powerful trading and linked watchlists directly from the chart with multiple chart views and advanced drawing tools.

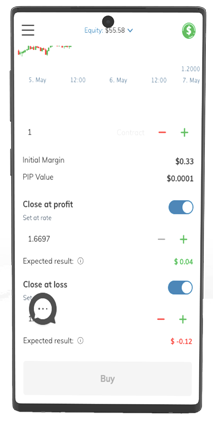

Order Types

Allowing traders easy entry to markets using a range of order types is central to our mobile experience. Trade market, stop, limit, and OCO while having the option of setting Stop Loss or Take Profit to trade positions and pending orders.

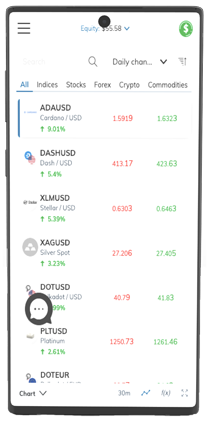

Watchlists

Custom and fully searchable watchlists can be created quickly and easily from within the app, enabling a powerful and personalised trading experience.

Enhanced Security

With support for both pin-based and biometric authentication, users have the option to use one or both to protect their accounts.

Delivering High Performance & Stability

Our mobile technology is optimised to provide enhanced stability during network switching and low bandwidth situations resulting in no lag market data, uninterrupted market pricing, and stable chart performance.

Account Statements

Traders have a complete overview of account history and transactions with the ability to run account statements directly from within the app.

Risk Management

Manage risk proactively and control brokerage operations directly from the Dealer terminal with our highly configurable, robust risk management tools. Our software facilitates extensive optimisation that protects both brokers and clients while maintaining maximum returns.

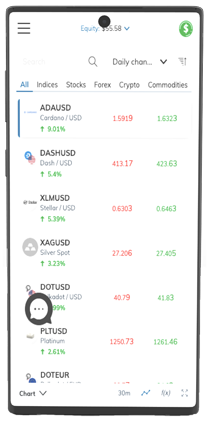

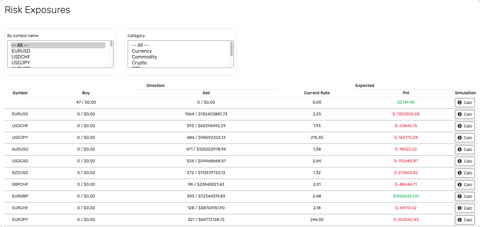

Real-time Exposure Monitor

Brokers can monitor their A/B book and hedged exposure in real-time, directly hedging from the exposure monitor while keeping an up to date view on Risk and P/L. Brokers also can filter, drilling down to view exposures and P/L on group, instrument and asset levels.

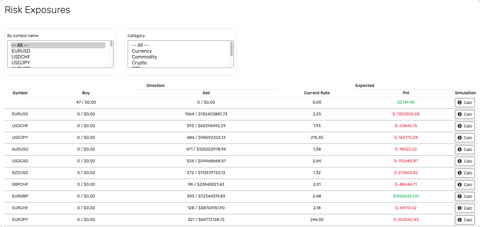

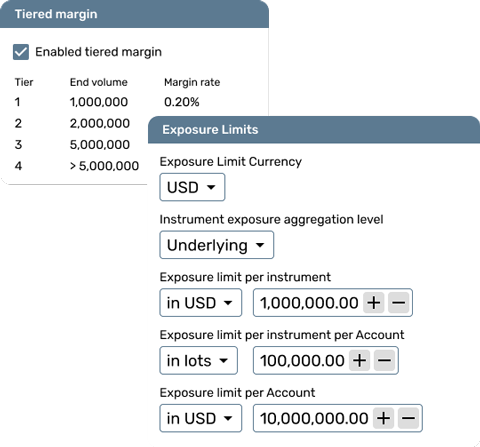

Risk Management groups and profiles setup

Brokers can apply settings using profiles, on an instrument, group or account level or as a combination of each, allowing brokers the agility

to manage risk in a more flexible environment. Configurable settings on instrument, group or account levels:

- Tiered or flat margins

- Trade size limits

- Trade and overall exposure limits

- Trading modes (full/close-only/disabled) – can be made in bulk changes for multiple clients

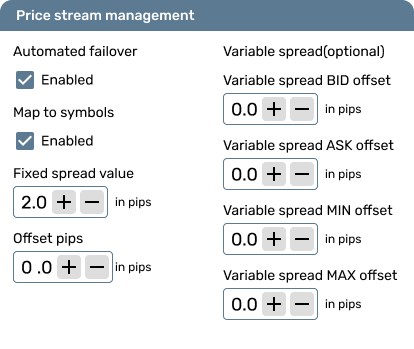

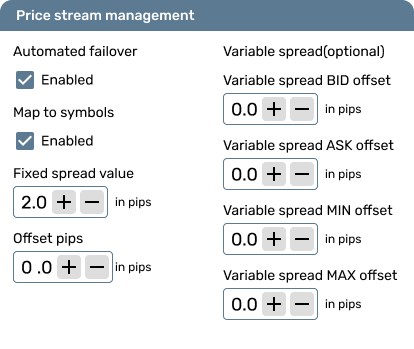

Easy to configure Prices

Brokers can monitor and quickly build multiple markup profiles on an instrument, group, or account level and set fixed/floating price streams using the same instrument, applying min/max spreads, advanced price filters and pricing failovers.

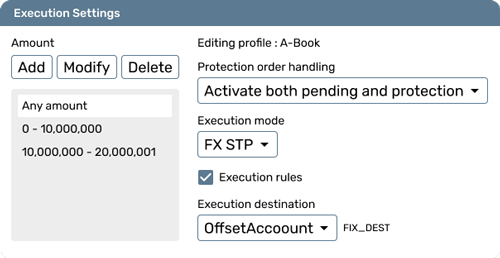

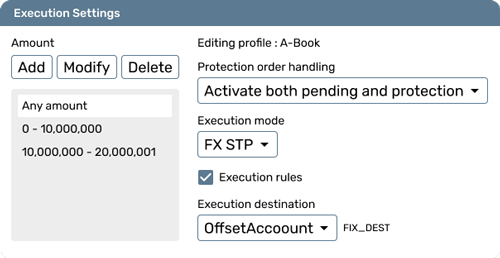

Enhanced execution settings that maximise revenue

Establish execution strategies using execution parameters like trade volume to assure the right level of risk/reward for each trade and set A/B book hedging destinations that are movable with a click for instruments or groups.

REQUEST A DEMO

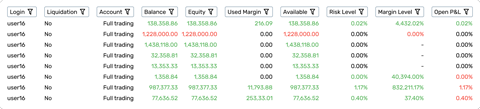

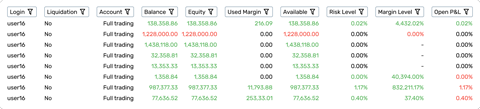

Account management and monitoring

Our comprehensive management suite enables brokers to monitor multiple accounts, metrics, or groups in real-time via pop-out widgets and create custom tags for monitoring abusive or high volume traders via multi-level filtering on every widget.

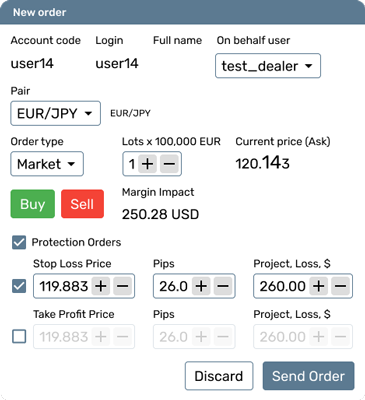

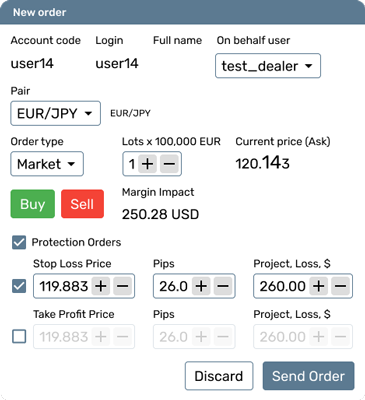

Trade on your clients’ behalf

The Dealer provides the ability to place pending and market orders at the current market rates or fill orders at a specific price — trade on behalf of clients from the account, account list, position list or order list widgets.

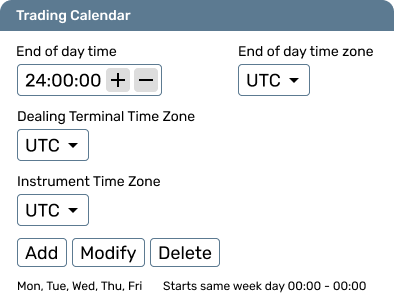

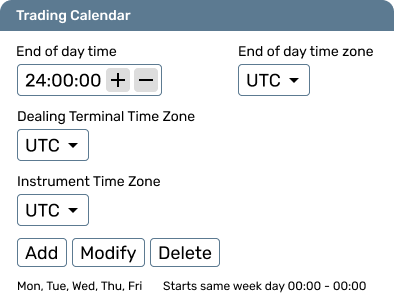

Trading Calendar

Set trading hours or market holidays and set instrument schedules using GMT, UTC, or LDN/NY time zones. Brokers can easily configure individual or multiple trading sessions for a single or group of instruments.

Broker views

With client and broker views of positions and orders, Broker views maintain clarity by enabling the management of their positions (A/B book) and exposures.

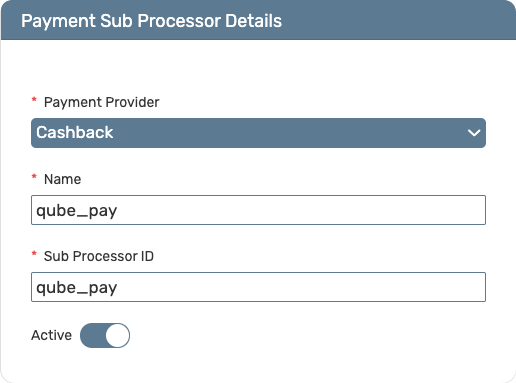

Management Console

Our web-based management console provides a simple, intuitive console for managing daily brokerage operations. Teams can easily create accounts, control groups, make account transactions, and perform trading rebates.

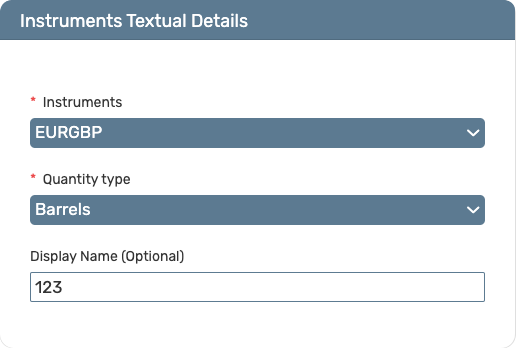

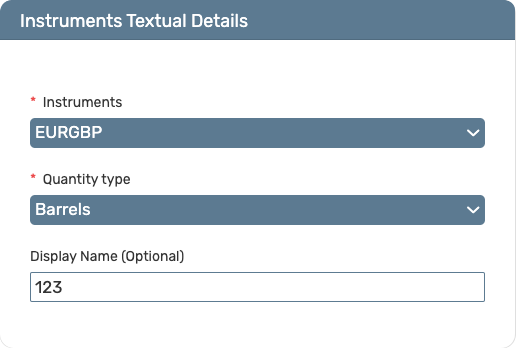

Instrument management and configuration

Quick and easy instrument mapping to your Liquidity Providers to instruments set up within the platform.

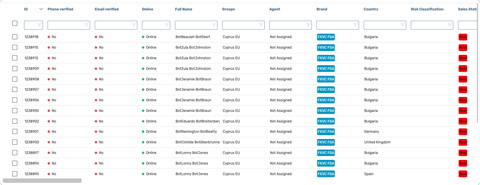

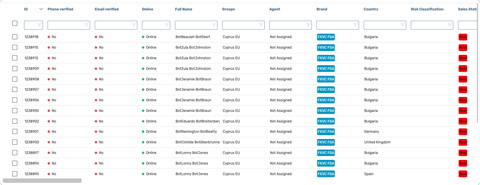

User account management

Brokers can create new accounts, edit details or assign groups, as well as monitor and terminate live account sessions and set trading status.

Swaps and Swap Free accounts

Using Swap rates or interest rates, brokers can apply overnight financing and markups for each instrument or group with the ability to implement swap multipliers and apply them to specific client groups or accounts. With a complete stored archive, brokers can easily retrieve all historical swap rates.

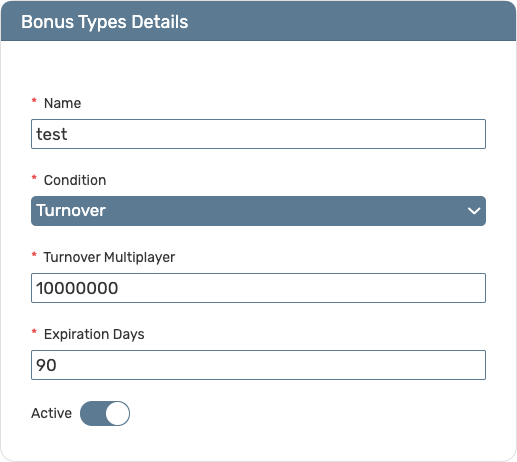

Volume Rebate Plans

Enhanced retention tools enable the rewarding of VIP traders with custom rebate plans on a tier-based system calculated by volume traded per asset class. Rebates are configurable to a weekly, bi-weekly and monthly basis and can be customised to apply on a group or account level.

Multiple commission plans

Commission plans are set based on percentage volume, flat rates, basis points, or combinations of each, with each commission plan applied on an instrument, group or account level.

Client Reporting

Produce client reports on profit, exposure and rebates paid/earned.

User Sessions

Brokers have complete control over all live user sessions with the ability to monitor activity, login time, IP address, and terminate any client(s) session.

Broker Hedging Accounts

Create broker hedging accounts and easily select execution destinations for all offset trades.

TT Webtrader

Our cutting-edge trading terminal for retail traders has a comprehensive set of powerful proprietary tools and functionalities aimed at traders of all experience levels. TT Webtrader is fully customisable by both traders and brokers to create a perfectly tailored trading experience.

Powerful charting capabilities

With multiple chart views and advanced drawing tools, traders can perform multi-timeframe technical analysis via our robust widget-based system, opening your traders to powerful trading and linked watchlists directly from the chart.

Fully customisable watchlists with enhanced multi-view

Trading directly from the list or tiled view, traders of any level can apply preconfigured Stop Loss/Take Profits with a simple click. Watchlists are entirely customisable and are available to both broker and client.

Easily customisable for both traders and brokers

The trading platform provides brokers and their traders with comprehensive control over system configuration to offer the perfect setup for the best possible experience. With configurable layouts, workspaces, watchlists, a modular interface, and multi-screen arrangements, brokers can surpass customer expectations and give traders the most powerful tools within a user-friendly environment.

Trading Dashboard

With data analysis and user experience at the centre of our motivation, our dashboard clearly and informatively displays trading performance and habits on an instrument, asset class or account level and presents metrics such as intraday performance, risk/reward ratios, win rates and winning/losing trade holding times.

REQUEST A DEMO

Trading Journal

The journal allows users to save notes on trades and positions, giving them future insights into why they entered or exited positions, thus enabling users to plan and strategise their trading

This innovative tool also promotes increased engagement throughout the platform.

Risk management for traders

Enhanced risk management tools for traders allows traders to achieve their desired risk:reward ratios by preconfiguring Stop Loss/Take Profit levels per instrument or easily factor in the % of Balance at risk when entering trades. The dashboard and journal let traders monitor their risk management performance on an account, instrument or asset class level.

For all trading styles

Available order types include market, limit, stop and OCO orders. For easy trading, one-click trading is possible across the platform. Brokers can choose from Hedging or Net-Based for their customers.

Mobile

Native apps for iOS and Android allow traders access to their accounts anytime, anywhere, providing real-time monitoring of trading portfolios, access to market data, and news.

Powerful Charting

An optimised mobile experience allows traders to perform multi-timeframe technical analysis via our robust widget-based system, opening your traders to powerful trading and linked watchlists directly from the chart with multiple chart views and advanced drawing tools.

Order Types

Allowing traders easy entry to markets using a range of order types is central to our mobile experience. Trade market, stop, limit, and OCO while having the option of setting Stop Loss or Take Profit to trade positions and pending orders.

Watchlists

Custom and fully searchable watchlists can be created quickly and easily from within the app, enabling a powerful and personalised trading experience.

Enhanced Security

With support for both pin-based and biometric authentication, users have the option to use one or both to protect their accounts.

Delivering High Performance & Stability

Our mobile technology is optimised to provide enhanced stability during network switching and low bandwidth situations resulting in no lag market data, uninterrupted market pricing, and stable chart performance.

Account Statements

Traders have a complete overview of account history and transactions with the ability to run account statements directly from within the app.

Risk Management

Manage risk proactively and control brokerage operations directly from the Dealer terminal with our highly configurable, robust risk management tools. Our software facilitates extensive optimisation that protects both brokers and clients while maintaining maximum returns.

Real-time Exposure Monitor

Brokers can monitor their A/B book and hedged exposure in real-time, directly hedging from the exposure monitor while keeping an up to date view on Risk and P/L. Brokers also can filter, drilling down to view exposures and P/L on group, instrument and asset levels.

Risk Management groups and profiles setup

Brokers can apply settings using profiles, on an instrument, group or account level or as a combination of each, allowing brokers the agility

to manage risk in a more flexible environment. Configurable settings on instrument, group or account levels:

- Tiered or flat margins

- Trade size limits

- Trade and overall exposure limits

- Trading modes (full/close-only/disabled) – can be made in bulk changes for multiple clients

Easy to configure Prices

Brokers can monitor and quickly build multiple markup profiles on an instrument, group, or account level and set fixed/floating price streams using the same instrument, applying min/max spreads, advanced price filters and pricing failovers.

Enhanced execution settings that maximise revenue

Establish execution strategies using execution parameters like trade volume to assure the right level of risk/reward for each trade and set A/B book hedging destinations that are movable with a click for instruments or groups.

REQUEST A DEMO

Account management and monitoring

Our comprehensive management suite enables brokers to monitor multiple accounts, metrics, or groups in real-time via pop-out widgets and create custom tags for monitoring abusive or high volume traders via multi-level filtering on every widget.

Trade on your clients’ behalf

The Dealer provides the ability to place pending and market orders at the current market rates or fill orders at a specific price — trade on behalf of clients from the account, account list, position list or order list widgets.

Trading Calendar

Set trading hours or market holidays and set instrument schedules using GMT, UTC, or LDN/NY time zones. Brokers can easily configure individual or multiple trading sessions for a single or group of instruments.

Broker views

With client and broker views of positions and orders, Broker views maintain clarity by enabling the management of their positions (A/B book) and exposures.

Management Console

Our web-based management console provides a simple, intuitive console for managing daily brokerage operations. Teams can easily create accounts, control groups, make account transactions, and perform trading rebates.

Instrument management and configuration

Quick and easy instrument mapping to your Liquidity Providers to instruments set up within the platform.

User account management

Brokers can create new accounts, edit details or assign groups, as well as monitor and terminate live account sessions and set trading status.

Swaps and Swap Free accounts

Using Swap rates or interest rates, brokers can apply overnight financing and markups for each instrument or group with the ability to implement swap multipliers and apply them to specific client groups or accounts. With a complete stored archive, brokers can easily retrieve all historical swap rates.

Volume Rebate Plans

Enhanced retention tools enable the rewarding of VIP traders with custom rebate plans on a tier-based system calculated by volume traded per asset class. Rebates are configurable to a weekly, bi-weekly and monthly basis and can be customised to apply on a group or account level.

Multiple commission plans

Commission plans are set based on percentage volume, flat rates, basis points, or combinations of each, with each commission plan applied on an instrument, group or account level.

Client Reporting

Produce client reports on profit, exposure and rebates paid/earned.

User Sessions

Brokers have complete control over all live user sessions with the ability to monitor activity, login time, IP address, and terminate any client(s) session.

Broker Hedging Accounts

Create broker hedging accounts and easily select execution destinations for all offset trades.